The common perception is that if one invests in ETFs or indices like the S&P 500, one is being “passive”. The media has additionally confused the definition by considering any rule-based or systematic strategy as passive investing. This poor understanding has led many investors astray, creating passive portfolios with poor diversification. Furthermore, it has introduced concealed and unnecessary risk into many investors’ portfolios. The goal of this post is to clarify the meaning of passive investing.

Defining the market:

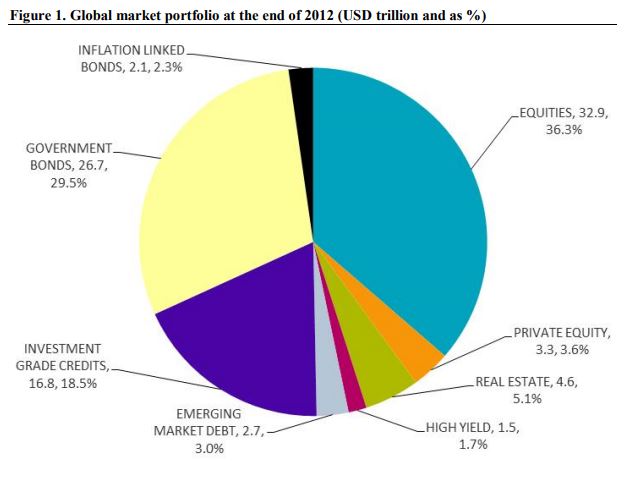

The academic term passive investing refers to investing in the market portfolio. And the market return is what a passive investor would be trying to match. But what is the “Market”? The market is the aggregate of all financial assets. However, there are also sub-markets. For example, the food market is the aggregate, where fruits are a sub-market, and apples and oranges are part of that sub-market. In the same way, we have the market for all available investable assets worldwide and sub-markets for separate asset classes like geographical regions, equities, treasuries, REITs, commodities, etc. Further, there are different companies’ equity securities or bond issues within the individual sub-markets. Hence, the market portfolio is all investable financial assets globally.

Defining passive investing:

Passive investing is not exhibiting preferences towards asset classes (sub-markets), securities, factors (growth vs. value), etc. Instead, passive investors take what the market gives them: the relative security market valuations, the allocated weight for each security as a portion of the total market. Thus, the passive portfolio involves holding all the securities and asset classes in their respective value-based weights. Put another way; securities are weighted based on their market capitalization divided by the market capitalization of all financial assets. Further, passive investing is not about reducing fees, minimum trading, or investing in an index. All of those are byproducts since it’s inexpensive to replicate the market, and it doesn’t involve a lot of trading (actually, no trading since weights will automatically adjust if an investor is entirely passive). Nevertheless, you can also have all those characteristics but be in a highly active portfolio.

Examine the below estimate of the global investable market portfolio based on asset classes:

Source: Doeswijk, R., Lam, T., and Swinkels, I., 2014, “The Global Multi-Asset Market Portfolio, 1959-2012”, Financial Analysts Journal 70(2), pp. 26-41.

I guess it is not what some expected.

Quick contrast to active investing:

Active investing is deviating from the market, such as having an overweight or underweight position (exhibiting preferences). For example, investors are active if all their money is in a US equities portfolio such as a value-weighted index (Wilshire 5000). In this extreme case, the investor is bullish on US stocks, and bearish towards bonds, international equities, real estate, emerging markets, etc. Just as you can be overexposed to a company’s stock, you can be overexposed to a country, asset class, specific factors like growth stocks, etc. To be passive, an investor must hold all the assets weighted in the portions they exist in the market. You are taking an active position if your allocation is anything else but the market portfolio. For example, equal-weighted, value, growth, and other deviations from market capitalization weights are active strategies. Also, don’t confuse passive investing with indexing or ETFs, if applied correctly, both are tools to achieve a passive portfolio efficiently but are not what constitutes being passive.

“One can be passive concerning a particular sub-market but be actively positioned overall.”

So, are you passively invested? I would take an active bet that most investors are even remotely passively allocated. Many investors exhibit biases and preferences. Most of us either hold large allocations in US stocks or bonds or are exposed to certain factors. There is nothing wrong with being an active investor if the investor understands the difference between their portfolio and the global market. Otherwise, an investor could be unaware of the risky exposures in their portfolio. Also, one will have many reasons to deviate from the passive portfolio throughout life driven by age, kids, home purchases, etc.