The open-end mutual fund structure has been around since the 18th century, thanks to a Dutch merchant. Mutual funds were introduced to the United States in the 1890s and gained popularity in the 1920s. The modern mutual fund has forgone additional changes to satisfy regulations. Currently, most retail assets are managed in open-end mutual funds. However, exchange-traded funds (ETFs) continue to gain popularity. There are multiple reasons why mutual funds have been losing assets to ETFs, some rational and others not. Let’s explore the primary mutual fund disadvantages compared to ETFs:

Capital Gains Tax Efficiency (applies mainly to US investors):

Equity mutual funds are less tax-efficient than comparable ETFs. The lower tax efficiency is due to how the operations of the two vehicles differ and how investors purchase the products. There are three fundamental differences between how ETFs handle subscriptions and redemptions compared to mutual funds and how this translates into better tax efficiency.

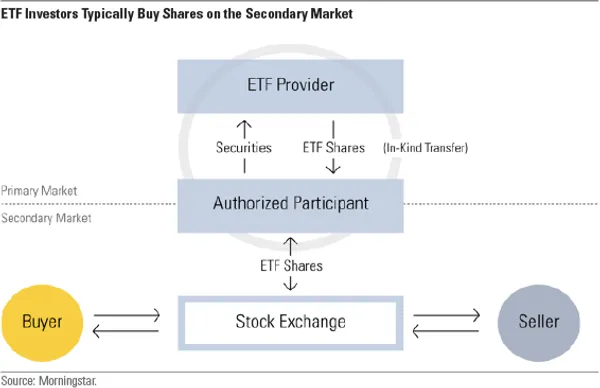

ETF investors trade directly with one another on an exchange. The direct exchange of ETF shares amongst investors means that the ETF managers do not need to sell any securities in the portfolio to raise cash for the selling investors. The direct transaction helps avoid forced disposals of securities with ingrained capital gains. On the other hand, mutual fund shares do not trade on an exchange, and investors must transfer their cash to the mutual fund company to participate in the fund. When someone wants to sell out of a mutual fund, if the portfolio manager doesn’t have the available cash, he will need to sell securities. If those securities are sold at a capital gain, the remaining investors in the mutual fund will have to bear the tax burden for the sale, even though they did not exit the fund.

For the other 10% of the time, when the supply and demand are not offsetting, equity ETFs can use in-kind transactions, not forcing the manager to sell any securities with embedded capital gains. ETF shares may only be created and redeemed by the Authorized Participants (for short APs), also known as market makers. As a result, if more investors try to sell ETF shares on the exchange while the demand is not enough to clear the transaction, the ETF price will begin to trade below Net Asset Value (NAV). When this happens, the APs will start delivering the oversupply of ETF shares to the ETF portfolio manager in exchange for receiving an equivalent value basket of securities directly from the ETF’s portfolio. The manager does not have to give the APs any particular basket of securities, just one equivalent in market value to the ETF shares sold. Also, the manager can provide the APs the securities with the highest embedded capital gains. Next, the APs will sell the basket of securities and deliver the cash to the selling investors. This separation of seller and manager means that only the selling investors will have a taxable event since the ETF manager avoids selling any securities with embedded cap gains for the remaining shareholders.

Although, equity ETFs rarely distribute capital gains. The same cannot be said for fixed-income ETFs since in-kind transactions are usually unavailable due to the significant variations of bond securities and their lack of liquidity. Also, ETFs do not avoid paying taxes on things like dividends and interest income.

Flow-related expenses:

Long-term mutual fund investors subsidize liquidity for short-term investors. When mutual fund investors move in and out of the fund, they generate transaction costs. The manager must either buy securities with the newly provided cash or sell securities to raise cash for the leaving investors. The trading activity generates expenses that reduce fund performance, hurting the remaining investors. ETFs deal in-kind, passing the transaction costs to the frequent traders (via the spread) and not affecting the performance of the long-term ETF investors. In a research paper, Roger Edelen quantified the adverse effect of shareholder entry and exit costs on fund performance (Edelen 1999). He found that the trading costs attributed to the liquidity offered to entering and exiting shareholders accounted for an average net reduction in annual investor return of more than one percent. One thing to remember is that the flow-related turnover expense will fluctuate depending on the liquidity of the securities in the fund (for example, small-cap vs. large-cap) and the size of the fund (larger fund trades will have the more significant market impact). Also, note that pricing decimalization and scandals in the early 2000s that caused many mutual funds to adopt investor protection mechanisms such as redemption fees have helped mitigate but not eliminate some of the flow-related costs. Nevertheless, these costs are high and are paid by long-term mutual fund investors. Through the in-kind process, Equity ETFs externalize and pass most of the trading costs to whom they belong, the investors transacting.

Uninvested cash (cash drag):

Mutual funds have to hold more cash to handle incoming redemptions. Since ETFs can perform redemption in-kind, they do not need to carry high amounts of cash. The uninvested cash position further drags mutual fund performance lower.

Other costs:

Mutual funds tend to be more expensive to operate. Since they trade on an exchange, ETF managers do not have to keep track of shareholders. However, mutual funds have the additional expense of transfer agency, reporting, and marketing materials. These costs can range from an extra 1 to 10 basis points depending on the size of the fund.

To summarize, most mutual fund disadvantages stem from cash redemptions. If ETFs experience outflows, the ETF manager can hand over a basket of the fund’s underlying securities instead of cash. It can also pick which securities to give the authorized participants, ridding itself of tax lots with the most significant embedded capital gains. Mutual funds are not required by law to use cash for all flow transactions, but for practical reasons, they do. However, trading ETFs frequently can make them more expensive than Mutual Funds, so neither vehicle is perfect.