SEG Active Index: US All-Cap Equities

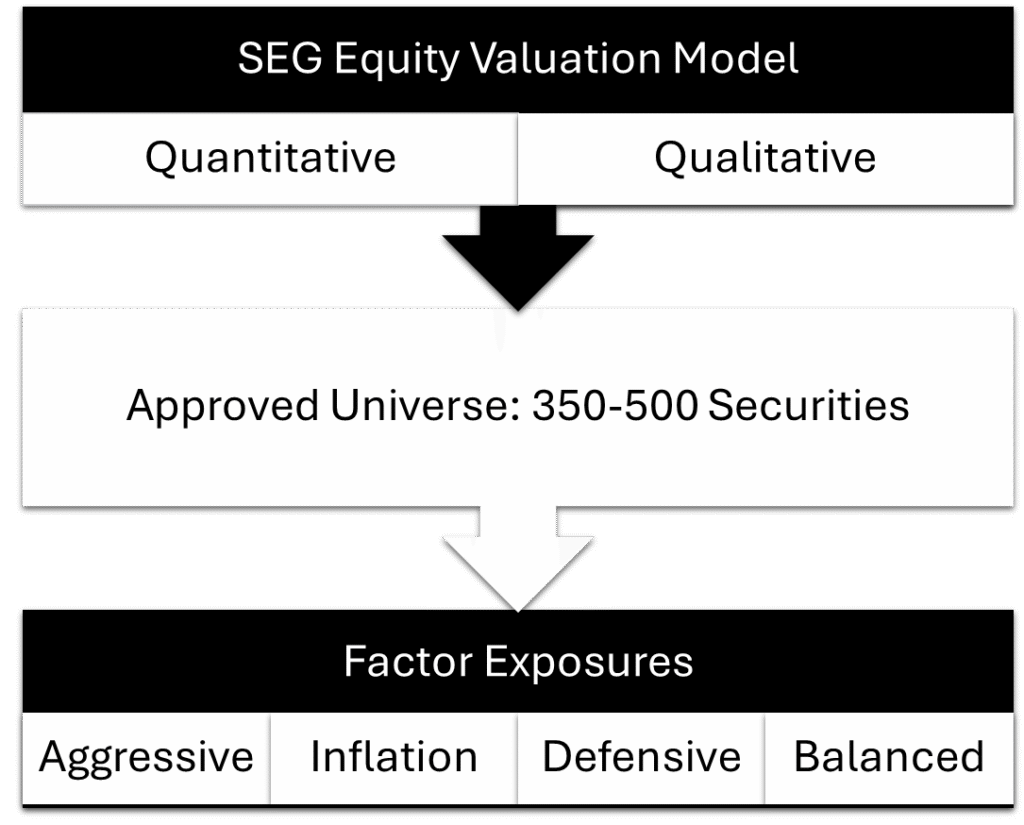

Our active indices for all-cap equities, a product of our exclusive research and models, stand out for their unique features. These active indices are designed to minimize turnover, thereby reducing transaction costs and capital gains.

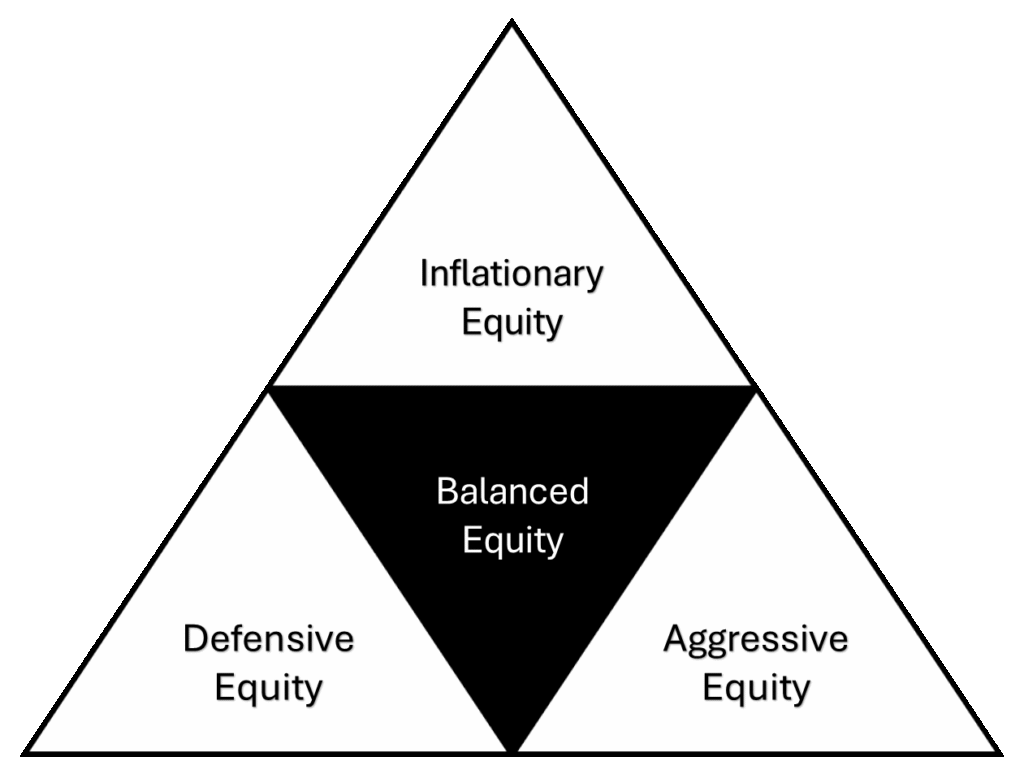

Counter to traditional equity investment styles, we believe that there are only three main types of equity investment styles:

- Inflationary: equities that are sensitive to rising inflation.

- Aggressive: equities that are growing faster than the economy and peers.

- Defensive: equities with stable and less sensitive to the business cycle and economy.

Our indices are built from our intrinsic valuation composite. Each index then overweighs specific factors relevant to its objective.

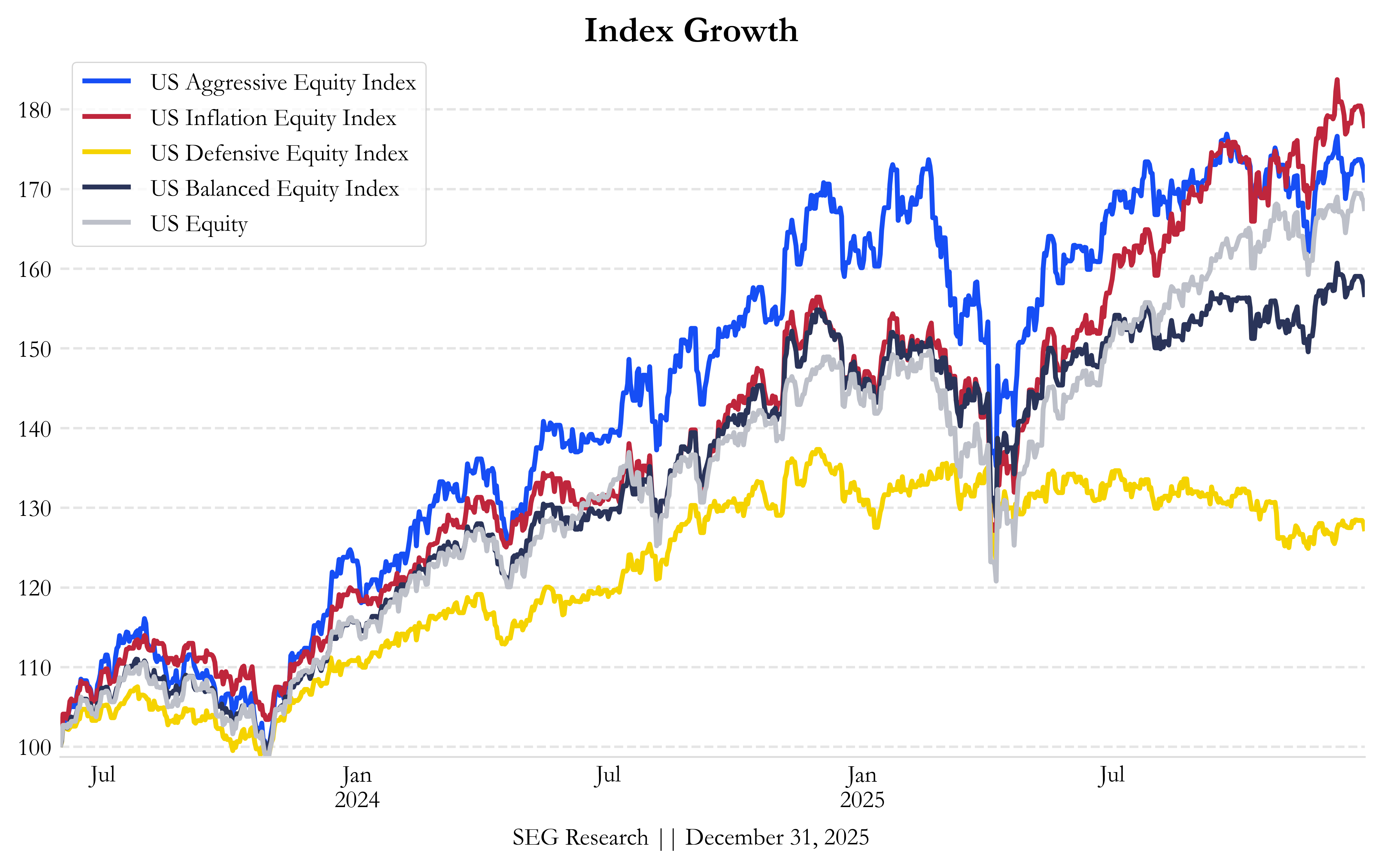

| Return | Std Dev | Max Drawdown | Down Capture Ratio | Up Capture Ratio | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|---|

| US Aggressive Equity Index | 22.99% | 22.54% | -22.14% | 121.87 | 118.19 | 1.12 | 1.13 |

| US Inflation Equity Index | 24.87% | 18.96% | -19.34% | 89.08 | 93.89 | 0.91 | 1.42 |

| US Defensive Equity Index | 9.70% | 13.72% | -10.24% | 58.59 | 55.91 | 0.55 | 0.54 |

| US Balanced Equity Index | 18.89% | 16.81% | -16.78% | 87.10 | 87.04 | 0.84 | 1.16 |

| US Equity | 21.99% | 18.01% | -18.93% | 100.00 | 100.00 | 1.00 | 1.27 |